Read this article and learn how to get money from using Venmo without a bank account in 4 ways.

Venmo is growing to be one of the most significant payment processors globally. The Venmo app had 52 million active users as of 2020 and had processed $159 billion in total payments.

The wonderful thing about new financial technology applications and payment processors is those numbers. People can get their money much faster than they could before by simply using a bank now that so many of these apps make payments convenient and quick.

But is it possible to use Venmo to receive funds without a bank account? It’s easy: If you don’t already have a Venmo debit card, you must get one if you want to use Venmo to get money without a bank account. Then you can use it to withdraw cash from an ATM, pay with Venmo, or make purchases offline or online.

Does Venmo Offer Cardless Withdrawals?

Simply put, no, cardless ATM withdrawals are not supported by Venmo. This means that you need to have a card on you in order to withdraw money from Venmo. The reason for this is that Venmo doesn’t yet have the functionality required to handle transactions of this nature built in.

Therefore, the only way to withdraw cash from Venmo is using your debit card at an ATM ($2.50 per withdrawal*) or in person ($3.00 per withdrawal) at most major bank or credit union branches, both of which require you to present your debit card.

How To Get Money From Venmo Without A Bank Account?

Use Another Account Or Card

You might have another bank account, debit card, or credit card that you can use to get cash from an ATM if you don’t have a Venmo card.

You can directly use a debit card that is connected to another bank account to make an ATM withdrawal if you have one. If you have a balance in your Venmo account that you’d specifically like to withdraw, you can link a bank account to your Venmo account by selecting Add a bank or card… and then Bank in your Venmo app settings.

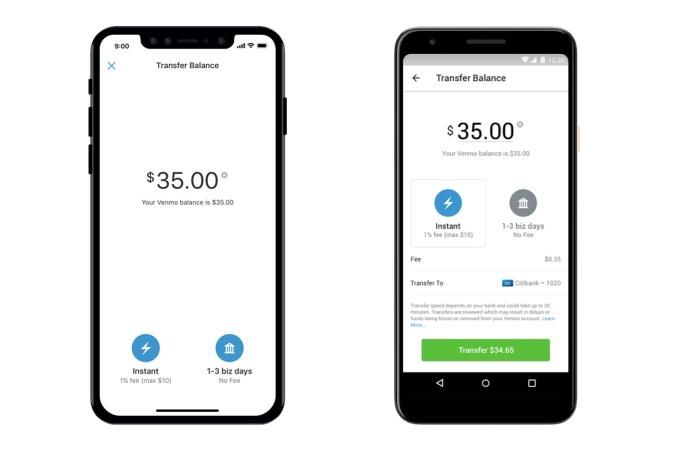

After you’ve verified your account, you’ll be able to transfer money from your Venmo balance to your bank account in one to three business days (for no fee using the 1-3 Biz Days option) or instantly (for a commission fee of 1.00% using the Instant option).

The money that was previously in your Venmo account can then be withdrawn using a debit card linked to another bank account after using this technique.

Naturally enough, if you’ve lost or forgotten your entire wallet, including your Venmo card, this method won’t work.

Ask A Friend To Do It For You

Asking a friend who does have a Venmo card and is willing and able to assist you to make the withdrawal on your behalf is a great choice if you don’t have a Venmo card yourself.

The good part about this option is that your friend will be able to receive your funds quickly, and you’ll only need to tap Pay and enter their username, phone number, or email to send them money to withdraw. If your friend is nearby, you can also use your app to instruct the payment by scanning their QR code.

Order A Venmo Card

Even though it may seem obvious, ordering a Venmo card could be a great choice for you if you don’t urgently need your case. The card won’t cost you anything to use regularly, and the next time you need to withdraw cash, it will be directly linked to your Venmo balance.

The delivery of the card should occur between five and seven days after you place your order.

Use A Global Debit Card

It doesn’t matter if you don’t have a Venmo card, misplaced it, or left it at home—using a prepaid debit card made for low-fee transactions, like ATM withdrawals, is the most efficient way to get cash.

You can completely avoid ATM withdrawal fees by using a competitive travel card product, even when traveling abroad and using foreign currency. (The only fees you might pay in these circumstances are the ATM’s network fees or a minimal Visa or Mastercard exchange rate markup, depending on the card.)

Open a Wise Multi-Currency Account if you frequently travel outside of the US. This account gives you access to a current online account, multi-currency balances, and a debit card.

How To Use A Venmo Card With A Bank Account?

You can load your Venmo debit card with money and use it anywhere a debit card is accepted once you have a Venmo account. There are several ways to load your Venmo card without using a bank that is linked to your Venmo account, despite the fact that you can. Here are some options to add to your Venmo balance without a bank account:

Direct Deposits

You can set up direct deposit with a Venmo account just like you can with a bank account. The routing and account numbers are required to be given to your employer, just as they would be for your bank account. After setting up direct deposit, you can have your paychecks deposited into your Venmo account so that you can access the funds with your Venmo debit card.

Depositing/cashing A Check

The Venmo app also offers the option to cash checks. You must use a mobile deposit to accomplish this by taking pictures of both the front and back of the check. then enter the check’s amount. Your mobile check deposit will be finished from this point. After that, you can make purchases online or in person using your Venmo debit card.

Deposit Or Withdraw Money At An ATM

Without having a bank account, you can make deposits or withdrawals using your Venmo debit card at an ATM. An ATM should accept a Venmo debit card if it also accepts Mastercard, PULSE, Cirrus, or MoneyPass. A Venmo debit card is not accepted at all free ATMs, so keep that in mind. Any ATM other than a Moneypass ATM will have a fee of $2.50 to $3.00.

Receiving Money From Another Person

Receiving money from someone else is an additional easy way to have money in your Venmo account. All they need to do is obtain your Venmo account details, which may include your email address, phone number, and username.

Alternatively, you can ask the other Venmo user for money. From this point, all they need to do is transfer the funds to your Venmo account so you can use your card.

Other Ways To Receive Money Safely

You won’t be able to access your Venmo funds without those options, despite the fact that Venmo can be useful with a bank account linked and a Venmo debit card. Here are some alternatives to Venmo to consider (some can be used without a bank account altogether):

Use A Built-in Bank Transfer Service

If you have a bank account, you can send or receive money using the built-in money transfer service. This kind of service with an online checking account is provided by many financial institutions. Customers of one large bank, Chase, can use Zelle from their computer or mobile device to instantly send or receive money from their bank account (there is no need to wait a few business days for this).

Wire Transfers

A wire transfer is an additional choice you can take into account if you’re sending or receiving money with or without a bank account. Transferring money nationally and internationally is comparatively simple with the use of wire transfers. One thing to keep in mind is that wire transfer scams are very prevalent when applying for online loan options, such as a payday loans online.

Money Orders

Without a bank account, money can be sent and received using money orders. A money order can be purchased from a financial institution like a bank or credit union, as well as from shops, grocers, and the US Post Office.

There might be a fee the sender of the money must pay when dealing with merchants and some banks. Bring a driver’s license or state ID with you when you pick up the money order. Money orders don’t have an expiration date, which makes them flexible.

Use A Prepaid Debit Card

By having them load your money onto a prepaid debit card, you can receive money from people without a bank account in another way. With this, a debit card linked to a checking or savings account is not necessary. You can use an existing card or obtain a new one from any sizable store, gas station, etc. A prepaid debit card can be easily loaded with money, and it will be secure.

Personal Checks

Having someone write you a personal check is one way to get money. For check deposits, you might require a bank account, but you can also cash a check. As long as you are familiar with the person paying you, this can be a relatively safe payment option. Because there are many effects of depositing a bad check! A photo ID with a government-issued photo should be carried with you.

Get Money Via Cash

Getting cash is possibly the simplest way to get the money you require. If you can meet up with the other party or individual, this will only work.

FAQs

Without A Bank Account, Can You Still Receive Money On Venmo?

Without a bank account, you can still receive money through Venmo. To receive the funds using some methods, such as direct deposit, you must possess a Venmo debit card.

How Do I Turn My Venmo Money Into Cash?

If you have a Venmo debit card, you can withdraw money from your account at any ATM that accepts MasterCard by using the card. Just be aware that there is a $2.50 fee for cash withdrawals from any ATM.

Can I Use Venmo To Get Cash At Walmart?

You can pay for your purchases at Walmart using Venmo in addition to MasterCard-accepting ATMs. You can transfer money from Venmo to Walmart without using a debit card or bank account by scanning the QR code at the checkout.

What Are Venmo Debit Card Fees?

An option for fee-free mobile payments is Venmo. Its debit and credit cards are also included in that. Application for one is cost-free, and shipping is also free. There is no additional charge for in-person or online purchases of goods or services.

The same holds true if you use the Venmo QR Code to make a payment. The only fees are for out-of-network ATM transactions ($2.50) and instant transfers (1.50%).